On February 24, 2020 Malcolm Polley presented to Daniel Lawson's Finance Seminar FIN 422 class.

Polley is currently the president and chief investment officer at Stewart Capital Advisors, an institutional investment manager that is a wholly owned subsidiary of S&T Bank. He also is an adjunct professor for the Eberly College of Business. Polley is a chartered financial analysta highly coveted designation in the financial industry. He also serves as a member and past president of the CFA Society of Pittsburgh. He invests with the thesis "purchasing good companies at good prices," focusing on value stocks rather than growth.

Malcolm has more than 25 years of experience in the investment and financial services industry, having begun his investment career on Black Friday, 1987. He has been quoted extensively in the business press and has been a frequent guest on CNBC's Squawk Box, Squawk on the Street, Power Lunch, and Closing Bell; Fox Business; Bloomberg TV; and Bloomberg Radio. Malcolm has also been quoted in Andrew Ross Sorkin's bestselling book, Too Big to Fail.

Polley presented his "Prepping for Zero" slide-deck in which he explored how demographics influence economic factors such as GDP, inflation, and consumer confidence. He compared the demographic makeup of several different countries and their historical economic data to show correlations between the two. One of the main demographic statistics Polley looked at was the working-age populationthe number of people between 16 and 65 years old. Countries that have shown declines in their working-age population have also shown a decline in GDP. Polley uses these macroeconomic observations to help maintain and create investment theses.

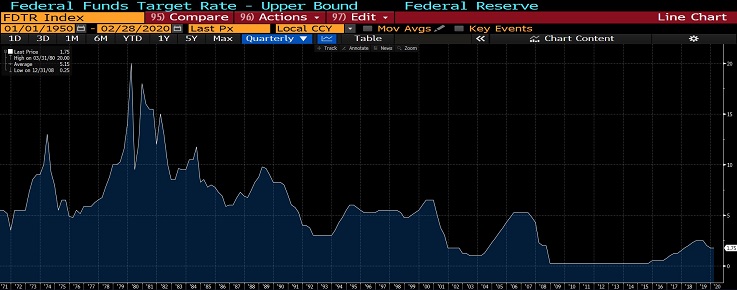

Polley also commented extensively on the Federal Funds Rate (referred to as the "Fed Funds Rate")the rate at which banks lend money to one another. The Federal Reserve is able to manipulate this rate to help control inflation. If the Federal Reserve increases this rate, things like mortgages will be more expensive to consumers and savings accounts will pay more. An increase in rates would slow down an "overheating" economy and help bring inflation back in check. He showed that if the Fed Funds Rate decreases, we will have experienced the lowest peak in Fed Funds Rate history. Recently, in other countries, the lending rates have fallen below zero, which contradicts the notion of "time value of money." Polley does notbelieve that the Fed Funds Rate will fall below zero.

Figure 1 - Historical Fed Funds Rate (retrieved from the Bloomberg Terminal)

The Eberly College of Business and Information Technology is extremely thankful to have professionals like Malcolm Polley speak about their line of work, recruit students for internships, and teach students different ways to think about investments.